SECURITIES AND EXCHANGE COMMISSION

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

the

Securities Exchange Act of 1934

(Amendment No. )

|

|

|

|

|

Not applicable.

| | ![[MISSING IMAGE: lg_nextera-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/lg_nextera-pn.jpg) | | | |

NextEra Energy, Inc. 700 Universe Boulevard Juno Beach, Florida 33408-0420 | ||||

Notice of 2022

Annual Meeting and

Proxy Statement

YOUR VOTE IS IMPORTANT

PLEASE SUBMIT YOUR PROXY PROMPTLY

NextEra Energy, Inc.

700 Universe Boulevard

Juno Beach, Florida 33408-0420

Notice of Annual Meeting of Shareholders

May 19, 2022

| | MEETING AGENDA | | | BOARD RECOMMENDATION | | ||||||

| | 1. | | | Election as directors of the nominees specified in the accompanying proxy | | | | | FOR each nominee | | |

| | 2. | | | Ratification of appointment of Deloitte & Touche LLP as NextEra Energy’s independent registered public accounting firm for | | | | | FOR | |

| | 3. | | | Approval, by non-binding advisory vote, of NextEra Energy’s compensation of its named executive officers as disclosed in the accompanying proxy | | | | | FOR | |

| | 4. |

| | A shareholder | | | | | AGAINST | |

| | 5. | | | A shareholder proposal entitled “Climate Lobbying Report” requesting a report on the Company’s lobbying and trade association memberships in relation to the Company’s emissions goal | | | | | AGAINST | | |

| | 6. | | | Such other business as may properly be brought before the annual meeting or any adjournment(s) or postponement(s) of the annual | | | | | | ||

26, 2024.

Regardless of whether

YOUR PROXY OR VOTING INSTRUCTIONS PROMPTLY SO THAT YOUR SHARES CAN BE VOTED.

| | | | | By order of the Board of Directors, W. SCOTT SEELEY Vice President, Compliance & Corporate Secretary Juno Beach, Florida April 1, 2024 | |

| | | IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD MAY 23, 2024 This proxy statement and the NextEra Energy 2023 annual report to shareholders are available at www.proxyvote.com. | | |

![[MISSING IMAGE: tm2228016d1-pht_matric4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/tm2228016d1-pht_matric4c.jpg)

OF FUTURE PROXY MATERIALS

By order of the Board of Directors,

W. Scott Seeley

Vice President, Compliance & Corporate Secretary

Juno Beach, Florida

April 1, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITYwhile reducing environmental impacts and costs.

| | | As one of the largest electric power and energy infrastructure companies in North America and a leader in the renewable energy industry, NextEra Energy is committed to building a sustainable energy future that is affordable, reliable and clean. We encourage our shareholders to enroll in e-delivery: | | |

| | | | Online at www.proxyvote.com/NEE | | |

| | | | Scan the QR code | |

THE ANNUAL MEETING TO BE HELD MAY 19, 2022

This proxy statement and the NextEra Energy 2021 annual report to shareholders are available at www.proxyvote.com.

Meeting Information

![[MISSING IMAGE: ic_caln-bw.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ic_caln-bw.gif) | | | TIME AND DATE | | | | | | PLACE | | | | | | RECORD DATE | | ||

| 8:00 a.m., | | | | 145 Town Center Ave., Big Sky, Montana 59716 | | | | March 26, 2024 | | ||||||||

| | | WEBCAST | | | | | | VOTING | | | | | | ADMISSION | | |||

|

| |||||||||||||||||

|

| |||||||||||||||||

| The Company will provide a live audio webcast of the annual meeting from its website at http:// | |||||||||||||||||

| www.nexteraenergy.com. | ||||||||||||||||||

| | | Shareholders as of the record date are entitled to vote. Each share of common stock, par value $.01 per share (“common stock”), is entitled to one vote for each director nominee and one vote for each of the other properly presented proposals to be voted. | |||||||||||||||

| | | An admission ticket is required to enter the annual meeting. See page | | ||||||||||||||

Voting Matters and Board Recommendations

| | PROPOSAL | | | BOARD VOTE RECOMMENDATION | | | PAGE REFERENCE | | ||||||

| | 1. | | | Election of directors | | | | | FOR each nominee | | | | ||

| | 2. | | | Ratification of appointment of Deloitte & Touche LLP as NextEra Energy’s independent registered public accounting firm for 2024 | | | | | FOR | | | | ||

| | 3. | | | Advisory vote to approve NextEra Energy’s compensation of its named executive officers | | | | | FOR | | | | ||

| | 4. | | | Shareholder Proposal – Board Matrix | | | | | AGAINST | | | | ||

| | 5. | | | Shareholder Proposal – Climate Lobbying Report | | | | | AGAINST | | | | ||

| | | BY INTERNET | | | | | | BY TELEPHONE | | | | | | BY | | | | | | IN PERSON | | ||||

| |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| |||||||||||||||||||||||||

| |||||||||||||||||||||||||

How to Vote

|

Go to the website www.proxyvote.com, 24 hours a day, seven days a week. You will need the control number that appears on your proxy card or on your Notice of Internet Availability of Proxy Materials (the “Notice”). | ||||||

| |

| Call 1-800-690-6903, 24 hours a day, seven days a week. You will need the control number that appears on your proxy card or Notice. | ||||

| |

| If you received a full paper set of materials, date and sign your proxy card exactly as your name appears on your proxy card and mail it in the enclosed, postage-paid envelope. If you received the Notice, you may request a proxy card by following the instructions in your Notice. Even if you received a full paper set of materials, you may still vote by internet or telephone. You do not need to mail the proxy card if you are voting by internet or telephone. | ||||

| |

| At the annual meeting. | | |||

1

Business Highlights

| | | | | | | | | | | | ||||

| | ~72 GW* in operation | | | | ~9,000 MEGAWATT (“MW”) wind, solar and storage origination at NextEra Energy Resources, LLC (“NextEra Energy Resources”) | | | | ~16,800 employees | | | | ~$177 B in total assets | |

| | | | | | | | | | | | ||||

| | HURRICANE RESTORATION Florida Power & Light Company’s (“FPL”) smart grid technology avoided nearly 70,000 outages during Hurricane Idalia | | | | ~71; ~9% GAAP and adjusted earnings per share (“EPS”) growth compared to 2022 | | | | ~20 GW year-end backlog at NextEra Energy Resources | | | | ~50% below the national average CO2 emissions rate | |

| | | | | | | | | | | | ||||

| | 89% improvement in NextEra Energy overall company safety performance since 2003 | | | | ~$85-$95 B expected capital deployment from 2022 through 2025 | | | | 56% five-year total shareholder return (“TSR”), outperforming the S&P 500 Utilities Index | | | | 96% of FPL’s transmission structures are now concrete or steel | |

Governance Highlights

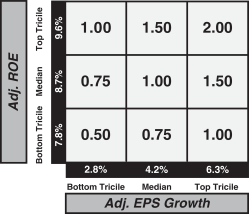

| | Metric | | | Rank | | | Detail | | |||

| | Adjusted EPS Growth* | | | | | #1 | | | | 3-, 5-, 7- and 10-year | |

| | Adjusted return on equity (“ROE”)* | | | | | #1 | | | | 1-, 3-, 5-, 7- and 10-year | |

In 2022, NextEra Energy was named by Fortune Magazine as the World’s Most Admired Electric & Gas Utility for the 15th time in the last 16 years. In 2021, Fortune recognized NextEra Energy on its list of companies that “change the world.” NextEra Energy was the only U.S. gas or electric utility to be so recognized in 2021.

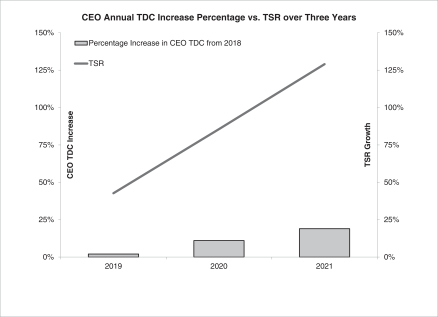

The returns that NextEra Energy generated for its shareholders were attributable to outstanding 2021 performance by the Company’s two principal operating businesses, Florida Power & Light Company (“FPL”) and NextEra Energy Resources, LLC and its subsidiaries (“NextEra Energy Resources”). Highlightsa reconciliation of this performance are described in more detail innon-GAAP financial measure to the Compensation Discussion & Analysis beginningmost directly comparable GAAP financial measure. See the 2023 Financial Performance Matrix section on page 39.

51 for more information on how the rankings are determined.

The chart below compares the Company’s TSR for the 1-, 3-, 5- and 10-year periods period ended December 31, 20212023 to the TSRs of the S&P 500 Electric Utilities Index, the S&P 500 Utilities Index, the Philadelphia Exchange Utility Sector Index (“UTY”)UTY, the S&P 500 and the S&P 500.500 Growth Index. NextEra Energy outperformed all of these indices over the periods shown with the exception of the S&P 500 1-year TSR. NextEra Energy’s outperformance in comparison to others in its industry, and over the 3-, 5- and 10-year periods in comparison to the S&P 500, was substantial.

NextEra Energy Total Shareholder Return Through 12-31-21 vs. Various Indices period shown.

1-year TSR | 3-year TSR | 5-year TSR | 10-year TSR | |||||||||||||||||

NextEra Energy |

| 23 | % |

| 129 | % |

| 252 | % |

| 710 | % | ||||||||

S&P 500 Electric Utilities Index, total return |

| 19 | % |

| 56 | % |

| 80 | % |

| 177 | % | ||||||||

S&P 500 Utilities Index, total return |

| 18 | % |

| 49 | % |

| 74 | % |

| 185 | % | ||||||||

UTY, total return |

| 18 | % |

| 54 | % |

| 80 | % |

| 182 | % | ||||||||

S&P 500, total return |

| 29 | % |

| 100 | % |

| 133 | % |

| 363 | % | ||||||||

![[MISSING IMAGE: bc_share-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/bc_share-pn.jpg)

|

|

|

2

Governance Highlights

| | 10-YEAR TSR | | ||||||

| | NextEra Energy | | | | | 267% | | |

| S&P 500 Electric Utilities Index, total return |

| | | | 146% | | | |

| | S&P 500 Utilities Index, total return | | | | | 135% | | |

| | UTY, total return | | | | | 133% | | |

| | S&P 500, total return | | | | | 211% | | |

| | S&P 500 Growth Index, total return | | | | | 250% | | |

| | | | | | | | | | | | ||||

| | DIRECTOR INDEPENDENCE | | | | BOARD LEADERSHIP | | | | BOARD ACCOUNTABILITY | | | | BOARD EVALUATION & EFFECTIVENESS | |

| | » 10 of

» CEO is the only non-independent

» All members of | |||||||||||||

| |

| » Independent Lead Director selected by the independent directors

» Lead Director has strong role and significant governance duties, including chairing | ||||||||||||

» As part of our Fall shareholder outreach program, Lead Director communicated directly with 30.9% of outstanding shares | ||||||||||||||

| |

| » All directors stand for election annually and the Board has adopted a resignation policy for directors who fail to receive the required vote in uncontested elections

» Simple majority voting standard for all uncontested director elections

» Shareholders of 20% or more of the outstanding shares may call a special meeting

» No shareholder rights (“poison pill”) plan

» No supermajority vote requirements in the Company’s Articles of Incorporation | ||||||||||||

| |

| » Annual Board and committee

» Annual independent director evaluation of the | |

| | | | | | | | | | | | | | | |||||

| | BOARD REFRESHMENT & DIVERSITY | | | | DIRECTOR ENGAGEMENT | | | | CLAWBACK & ANTI-HEDGING POLICIES | | | | SHARE OWNERSHIP | | | | PROXY ACCESS | |

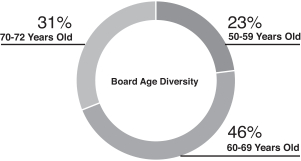

» Balance of new and experienced directors, with tenure of director nominees averaging

» Specified retirement age for directors

» 36% of » Average age of » 18% of | ||||||||||||||||||

| director nominees are ethnically diverse | ||||||||||||||||||

| |

| » All current directors

» Board policy limits non-employee director membership on other public company boards to three | ||||||||||||||||

| |

| » Recoupment or clawback policy to recover certain executive pay

» Policy prohibiting short sales, hedging and margin accounts | ||||||||||||||||

» Updated clawback policy to comply with NYSE rules | ||||||||||||||||||

| |

| » CEO required to hold shares equivalent to 7x base salary

» All senior executives required to hold

» Directors required to hold shares equivalent to 7x the cash portion of their annual retainer | ||||||||||||||||

| |

| » Available to a shareholder, or group of up to 20 shareholders, owning 3% of the Company’s outstanding shares for at least

» May nominate candidates for the greater of | |

3

2021 Environmental, Social*

Enhanced ESG Reporting.

![[MISSING IMAGE: tm2228016d1-pht_report4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/tm2228016d1-pht_report4c.jpg)

| | | | | | | | | | |||||

| | Emission Reduction The Company’s goal to |

| | | | The Company’s CO2 emissions rate in | | | | FPL’s generation fleet is one of the cleanest and most efficient in the country, saving Florida customers more than ~$15 billion in avoided fuel costs* | | | | 0 FPL has no coal-fired power generation in Florida | | ||

| | | | | | | | | | | | ||||

| | 25%WOMEN / 41%MINORITIES The diversity of our employees in 2022, including 25% women and 41% minorities in our workforce, with 27% and 29%, respectively, in our management ranks | | | | ~1.2 B Awarded, in the most recent federal reporting period, ~$1.2 billion in purchase contracts to minority- and women- owned businesses | | | | SUSTAINABILITY FOCUS The Board’s oversight process of sustainability issues, with a particular focus on the sustainability of our business | | | | SHAREHOLDER ENGAGEMENT Our successful shareholder engagement efforts, which ensure that the Company’s management and the Board better understand shareholder priorities and perspectives and enables us to effectively address the issues that matter most to our shareholders | |

FPL’s “30-by-30” plan to install 30 million solar panels in Florida by 2030 achieved a major milestone by completing approximately 40%

FPL’s

The Company’s awarding, in the most recent federal reporting period, $633 million in purchase contracts to small, minority and veteran owned businesses;

The Board’s oversight process of ESG issues, with a particular focus on the sustainability of our business; and

Our successful shareholder engagement efforts, which ensure that the Company’s management and the Board better understand shareholder priorities and perspectives.

The 2021 ESG2023 Sustainability Report also includes disclosure within the following established environmental reporting frameworks:

Additionally, in 2021, the Company participated in the Carbon Disclosure Project (“CDP”) survey for the first time in over ten years and received an “A level” leadership score. The Company’s response is available at http://www.investor.nexteraenergy.com/sustainability/esg-resources.

sustainability- resources under Related Information.

| | Additionally, in 2023, the Company again participated in the Carbon Disclosure Project (“CDP”) survey. ![[MISSING IMAGE: tm2228016d1-lg_cdp4c.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/tm2228016d1-lg_cdp4c.jpg) | | | | The Company’s 2023 Sustainability Report and CDP survey response are available at: | |

4

The Board of Directors also has oversight of certain social topics relevant to the Company. The Board reviews the Company’s diversity and inclusion and talent management strategy at least annually, including human capital and diversity metrics. The Board also focuses on diversity in the Company’s talent pipeline and reviews the diversity metrics of the Company’s internship program.

Information Security. NextEra Energy’s Audit Committee receives regular reports on the key risks facing the Company from the Corporate Risk Committee and also receives frequent reports from the Company’s Internal Auditor about the results of reviews of cybersecurity and information security governance. The Board annually receives a cybersecurity report from the Company’s Chief Information Officer and its Vice President, IT Infrastructure & Cybersecurity.

Varying leading third parties periodically assess the Company’s alignment with the U.S. Department of Energy’s Cyber Capability Maturity Model (a/k/a C2M2) standard, which is the predominate cyber security framework for the U.S. electric utility industry. NextEra Energy has a comprehensive cybersecurity training program in which all employees receive education and training on prevention of cybersecurity problems and on privacy and data protection.

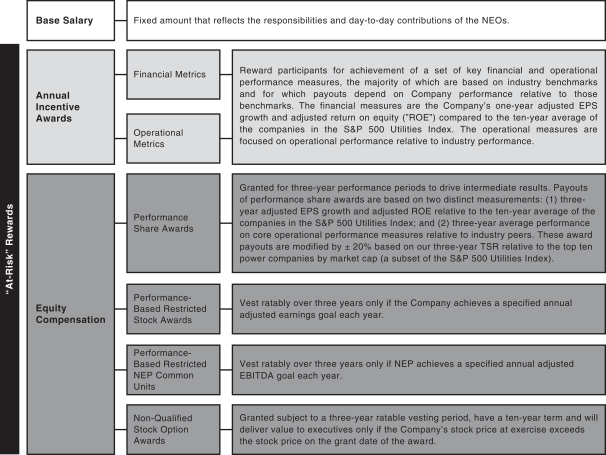

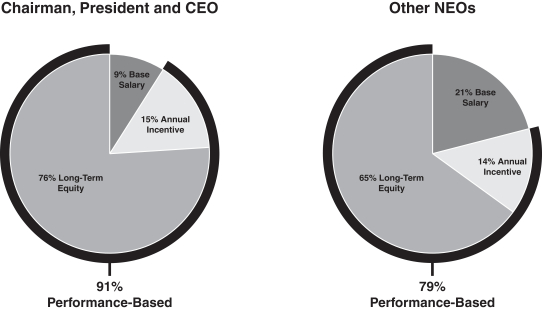

No Changes to Compensation Awards or Plans. In light of the Company’s superior performance despite the COVID-19 pandemic, no changes to prior compensation awards or previously established compensation plans were necessary or appropriate in 2021 and no such changes are planned for 2022.

The Company plans to continue its outreach during 2022 on these and other ESG topics.

5

In 2023, we reached out to 73 of our 100 largest shareholders, representing approximately 58.3% of shares outstanding (including all top 50 shareholders), and offered to engage on matters important to them, including governance and compensation. We held engagements with 22 shareholders representing approximately 36.3% of the Company’s shares outstanding, and received valuable feedback on our governance and compensation program. Our Lead Director, Sherry S. Barrat, participated in 8 shareholder engagements, representing 30.9% of shares outstanding. The feedback we received was shared with the full Board and has been considered in certain enhancements we have made to our executive compensation program and related disclosures as described in more detail on page 42. ![[MISSING IMAGE: fc_business-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/fc_business-pn.jpg)

ProposalPROPOSAL 1: Election as directors of the nominees specified in this proxy statement

| | ![[MISSING IMAGE: ph_nicolesarnaboldi-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_nicolesarnaboldi-bwlr.jpg) | | | | ![[MISSING IMAGE: ph_jameslcamaren-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_jameslcamaren-bw.jpg) | | | | ![[MISSING IMAGE: ph_gursahaney-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_gursahaney-bw.jpg) | | | | ![[MISSING IMAGE: ph_kirkhachigian-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_kirkhachigian-bw.jpg) | | | | ![[MISSING IMAGE: ph_mariahenry-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_mariahenry-bwlr.jpg) | | | | | |

| | Nicole S. Arnaboldi | | | | James L. Camaren | | | | Naren K. Gursahaney | | | | Kirk S. Hachigian | | | | Maria G. Henry | | | | ||

| | ![[MISSING IMAGE: ph_johnketchumsm-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_johnketchumsm-bw.jpg) | | | | ![[MISSING IMAGE: ph_amylane-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_amylane-bw.jpg) | | | | ![[MISSING IMAGE: ph_davidporges-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_davidporges-bwlr.jpg) | | | | ![[MISSING IMAGE: ph_devstahlkopf-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_devstahlkopf-bw.jpg) | | | | ![[MISSING IMAGE: ph_johnstall-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_johnstall-bw.jpg) | | | | ![[MISSING IMAGE: ph_darrylwilson-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_darrylwilson-bw.jpg) | |

| | John W. Ketchum | | | | Amy B. Lane | | | | David L. Porges | | | | Deborah L. “Dev” Stahlkopf | | | | John A. Stall | | | | Darryl L. Wilson | |

diversity

board recruiting at every committee meeting.

6

self-evaluation, it reviews the criteria for skills, experience and diversity reflected in the Board’s membership and also reviews the Board’s process for identification, consideration, recruitment and nomination of prospective Board members.

John W. Ketchum, who was appointed to the Board in March 2022, is an incumbent nominee for election to the Board this year who previously has not been elected by the Company’s shareholders. Mr. Ketchum was appointed to the Board in connection with the implementation of the Company’s CEO succession plan. Under the Company’s Governance Guidelines, the Company’s CEO serves as a member of the Board. Mr. Ketchum has served as the Company’s CEO since March 2022 and has over nineteen years of experience with the Company, including as CEO of NextEra Energy Resources and as the Company’s executive vice president, finance and chief financial officer.

Additionally, John A. Stall

September 2023.

directors

resignation policy

7

Director Qualifications

qualifications

| | DIRECTOR QUALIFICATIONS | | | COMPETENCIES AND RELEVANCE TO NEXTERA ENERGY | | | BOARD COMPOSITION | | |||

| | Individuals who have served as a public company CEO | | | | | PUBLIC COMPANY CEO EXPERIENCE Experience serving as a CEO provides unique perspectives to help the Board independently oversee NextEra Energy’s CEO and management. Having this experience also increases the Board’s understanding and appreciation of the many facets of running a public company, including strategic planning, financial reporting, compliance and risk oversight. | | | ![[MISSING IMAGE: pc_publicceo-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_publicceo-pn.gif) | | |

| | Demonstrated expertise in managing large, relatively complex organizations, such as leadership roles of a significant company or organization | | | | | STRATEGY EXPERTISE Our Company operates in a quickly changing industry with new developing technologies. Having experience in developing and implementing strategic plans helps enable the Board to oversee and pivot in rapidly changing environments. | | | ![[MISSING IMAGE: pc_strategyexpert-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_strategyexpert-pn.gif) | | |

| | | | OPERATIONS MANAGEMENT AND LEADERSHIP Our Company has a strong focus on cost and customer value, as well as innovation. Having experience with operations assists the Board in understanding the issues that the Company faces in achieving its industry-leading operating and maintenance (“O&M”) initiatives and reducing costs. | | | ![[MISSING IMAGE: pc_leadership-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_leadership-pn.gif) | | ||||

| | | | MERGERS & ACQUISITIONS EXPERIENCE Our Company from time to time acquires and disposes of businesses and assets. An understanding of mergers & acquisitions helps the Board evaluate any future transactions and any associated opportunities and risks. | | | ![[MISSING IMAGE: pc_mergers-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_mergers-pn.gif) | | ||||

| | Experience leading a utility, energy company or other highly regulated organization, such as CEO or other leadership position | | | | | UTILITY/REGULATED INDUSTRY LEADERSHIP As a company in a highly regulated industry, experience in the utility industry or another regulated industry assists the Board in understanding the regulatory issues that the Company faces. | | | ![[MISSING IMAGE: pc_utility-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_utility-pn.gif) | | |

| | | | ENERGY INDUSTRY LEADERSHIP It is important that the Board understand the energy industry and the complete energy industry value chain. Energy industry leadership assists the Board in understanding all aspects of the ongoing energy transition. | | | ![[MISSING IMAGE: pc_energy-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_energy-pn.gif) | | ||||

| | Financial or other risk management expertise | | | | | FINANCIAL Our Company’s business involves complex financial management, capital allocation and reporting issues. An understanding of finance and financial reporting is valuable in order to promote effective capital allocation and robust controls and oversight of accurate financial reporting. | | | ![[MISSING IMAGE: pc_financialrisk-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_financialrisk-pn.gif) | | |

| | | | RISK MANAGEMENT The scale, scope and complexity of our Company’s business raises a variety of interdependent risks. Experience in effectively identifying, prioritizing and managing a broad spectrum of risks can help the Board appreciate, anticipate and oversee the Company in managing the risks that face its various businesses. | | | ![[MISSING IMAGE: pc_riskmanage-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_riskmanage-pn.gif) | | ||||

| | DIRECTOR QUALIFICATIONS | | | COMPETENCIES AND RELEVANCE TO NEXTERA ENERGY | | | BOARD COMPOSITION | | |||

| | Experience serving in senior customer facing roles or in industries where customer service is strategically important | | | | | MARKETING, SALES AND CUSTOMER SERVICE EXPERIENCE FPL services over five million customer accounts in the state of Florida. NextEra Energy Resources also has a number of customer and consumer facing businesses serving thousands of customers. Experience in marketing, sales and customer service helps the Board oversee FPL’s best-in-class customer value proposition and NextEra Energy Resources’ growing consumer facing businesses. We also have customer and consumer facing businesses at NextEra Energy Resources. | | | ![[MISSING IMAGE: pc_marketing-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_marketing-pn.gif) | | |

| | Experience in managing engineering and construction projects | | | | | ENGINEERING AND CONSTRUCTION LEADERSHIP In 2023, the Company invested approximately $25 billion in energy infrastructure and NextEra Energy Resources commissioned approximately 5,025 MWs of renewable energy projects. Board experience in engineering and construction leadership assists the Board in its oversight of our large-scale capital investments and on our timely and on budget capital project execution. | | | ![[MISSING IMAGE: pc_engineering-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_engineering-pn.gif) | | |

| | Experience with information technology and cybersecurity | | | | | INFORMATION TECHNOLOGY LEADERSHIP Oversight of the protection of customer information and cybersecurity is critical to providing reliable electric service at both FPL and NextEra Energy Resources. Board experience in information technology leadership assists the Board in its oversight of our cybersecurity programs. | | | ![[MISSING IMAGE: pc_information-pn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_information-pn.gif) | | |

| | Experience | | | Arnaboldi | | | Barrat | | | Camaren | | | Dunn | | | Gursahaney | | | Hachigian | | | Henry | | | Ketchum | | | Lane | | | Porges | | | Stahlkopf | | | Stall | | | Wilson | | ||||||||||||||||||||||||||||||||||||||||

Public Company CEO Experience

| |

| | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | ||

| Financial Industry Experience & Leadership |

| |

| | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | | | | ||

| | Strategy Expertise | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | |

| | Operations Management

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | |

| | International Experience | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | |

| | Utility / Regulated Industry Leadership | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | |

| | Political / Legislative Experience | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | |

| | Energy Industry Leadership | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | |

| | Engineering & Construction Industry Experience | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | |

| | Nuclear Operations Leadership | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | |

| | Risk Management Leadership | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | |

| | Mergers & Acquisitions Experience

| |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8

| | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | X | | | ||||

| Information Technology / Cyber Experience | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | | | | ||||

| Investor Relations Management |

| |

| | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | | | | | | | | | | ||

| |

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Marketing / Sales

| |

| | | X | | | | | | X | | | | | | | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | X | | | |

| New Business Development/Development |

| |

|

9

| | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | X | | | ||||

| Human Resources Development | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | |||

| Trading/Derivatives |

| |

| | | | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Gender | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Female | | | | | X | | | | | | X | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | | | |

| | Male | | | | | | | | | | | | | | | | | X | | | | | | X | | | | | | X | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | | | | | | | X | | | | | | X | | |

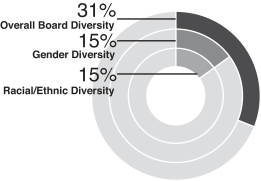

Board Gender and Race/Ethnic Diversity

![[MISSING IMAGE: pc_board-pn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/pc_board-pn.jpg)

| | NICOLE S. ARNABOLDI | | | Age 65 | | | Independent director since 2022 | |

|  |

10

Board Committees » Audit » Finance & Investment Public Company

» Manulife Financial Corporation (since

| |

| Career Highlights Ms. Arnaboldi has been a partner at Oak Hill Capital Management since 2021. She was previously the vice chairman of 1996. | | | Qualifications

Ms. Arnaboldi has | |

| | JAMES L. CAMAREN | | | Age 69 | | | Independent director since 2002 | |

| | ||||||||

![[MISSING IMAGE: ph_jameslcamaren-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_jameslcamaren-bw.jpg) Board Committees » Compensation » Finance & Investment | | |||||||

| | ||||||||

|

Career Highlights Mr. Camaren is a private investor. Until May 2006, he was chairman and CEO of Utilities, Inc. which was one of the largest investor-owned water utilities in the United States until March 2002 when it was acquired by Nuon, a Dutch company, which subsequently sold Utilities, Inc. in April 2006. He joined Utilities, Inc. in 1987 and served successively as vice president of business development, executive vice president, and vice chairman, becoming chairman and CEO in 1996. | | | Qualifications Mr. Camaren has 19 years of leadership experience with a large, regulated investor-owned utility. During the years he served as chairman and CEO, the utility had customer growth at a rate that exceeded the industry average and acquired and integrated over 40 utilities. In addition, Mr. Camaren has experience in managing capital expenditures, environmental compliance, regulatory affairs and investor relations. | |

11

| | NAREN K. GURSAHANEY | | | Age 62 | | | Independent director since 2014 | |

|

![[MISSING IMAGE: ph_gursahaney-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_gursahaney-bw.jpg) Board Committees » Audit (Chair) » Executive » Governance &

| |||||||

Nominating Public Company

» Stericycle, Inc. (since | |

| Career Highlights Mr. Gursahaney is retired. He served as the president and CEO, and a member of the board of directors, of The ADT Corporation (“ADT”), a provider of security systems and services, from September 2012 until its acquisition by affiliated funds of Apollo Global Management LLC in May 2016. Prior to ADT’s separation from Tyco International Ltd. (“Tyco”) in September 2012, Mr. Gursahaney served as president of Tyco’s ADT North American Residential business segment and was the president of Tyco Security Solutions, then a provider of electronic security to residential, commercial, industrial and governmental customers and the largest operating segment of Tyco. Mr. Gursahaney joined Tyco in 2003 as senior vice president of operational excellence. He then served as president of Tyco Engineered Products and Services and president of Tyco Flow Control. Prior to joining Tyco, Mr. Gursahaney was president and CEO of GE Medical Systems Asia, where he was responsible for the company’s sales and services business in the Asia-Pacific region. During his 10-year career with GE, Mr. Gursahaney held senior leadership roles in services, marketing and information management. | | | Qualifications Mr. Gursahaney has extensive operations, strategic planning and leadership experience in global manufacturing and services businesses serving residential, commercial, industrial and governmental customers gained as the CEO of a public company providing security systems and service. He also has extensive global operations, information technology and service experience gained as the president and CEO of the Asia-Pacific division of a medical diagnostic and imaging manufacturer. He has | | |

12

| | KIRK S. HACHIGIAN | | | Age 64 | | | Independent director since 2013 | |

| ![[MISSING IMAGE: ph_kirkhachigian-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_kirkhachigian-bw.jpg) Board Committees » Compensation (Chair) » Executive » Governance & Nominating Public Company

» Allegion plc (since 2013) » PACCAR, Inc. (since 2008)

» L3 Harris Technologies, Inc. (since | |

| Career Highlights Mr. Hachigian served as chairman of the board of JELD-WEN Holding, Inc., a manufacturer of windows and doors, from April 2014 until May 2018. He also served as CEO of JELD-WEN Holding, Inc. from April 2014 until November 2015. He served as chairman, president and CEO of Cooper Industries plc (“Cooper”), a publicly held electrical equipment and tool manufacturer, until Cooper’s acquisition by Eaton Corporation plc in November 2012. He was named chairman of Cooper in 2006, CEO in 2005 and president in 2004. | | | Qualifications Mr. Hachigian has extensive leadership, operations and strategic planning experience gained through his prior service as the chairman, CEO and president of a global, publicly held manufacturer of electrical equipment and tools. He also has international leadership and operations experience gained through his prior service as the president and CEO of the Asia-Pacific operations of a lighting products manufacturer and in key management positions in Singapore and Mexico. In addition, Mr. Hachigian has financial and risk oversight experience developed through his prior service on the audit committee of another public company and as a prior member of the board of the Houston branch of the Federal Reserve Bank of Dallas. He has | |

| | MARIA G. HENRY | | | Age: 57 | | | Independent director since 2023 | |

| | ![[MISSING IMAGE: ph_mariahenry-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_mariahenry-bwlr.jpg) Board Committees » Finance & Investment Public Company Boards » General Mills, Inc. (since 2016) » NIKE, Inc. (since May 2023) | | | Career Highlights Ms. Henry was chief financial officer of Kimberly-Clark Corporation from April 2015 through April 2022, and served as executive vice president and senior advisor of Kimberly-Clark Corporation from April 2022 until her retirement in September 2022. Prior to Kimberly-Clark, Ms. Henry was executive vice president and chief financial officer of the Hillshire Brands Company, formerly known as Sara Lee Corporation, from 2012 to 2014. She was the chief financial officer of Sara Lee’s North American Retail and Foodservice business from 2011 to 2012. Prior to Sara Lee, Ms. Henry held various senior leadership positions in finance and strategy in three portfolio companies of Clayton, Dubilier & Rice, most recently as executive vice president and chief financial officer of Culligan International. She also held senior finance roles in several technology companies and began her career at General Electric. | | | Qualifications Ms. Henry has extensive leadership experience in finance and strategy for large global public, private equity controlled, and smaller entrepreneurial companies across consumer, technology, manufacturing and distribution industries. She has had oversight responsibility for finance, treasury, investor relations, strategy, real estate and accounting. She also has experience overseeing information technology and risk, including cyber risk. Ms. Henry currently serves on the boards of directors of NIKE, Inc. and General Mills, Inc. She holds a Bachelor of Science degree in finance from the University of Maryland. | |

| | JOHN W. KETCHUM | | | Age 53 | | | Director since 2022 | |

| | ||||||||

13

Board Committees » Executive (Chair) » Nuclear Public Company

» NextEra Energy Partners, LP (since 2017) | |

| Career Highlights Mr. Ketchum has been president and own contracted clean energy projects (in which the Company owns an underlying 52.6% interest). | | | Qualifications Mr. Ketchum has a diverse business, finance and legal background with a broad range of experiences gained through his key executive roles at NextEra Energy, NextEra Energy Resources and NEP. During his | |

| | AMY B. LANE | | | Age 71 | | | Independent director since 2015 | |

| | ||||||||

14

Board Committees » Executive » Finance & Investment » Governance & Nominating (Chair) Public Company

» FedEx Corp. (since 2022) » The TJX Companies, Inc. (since 2005)

| |

| Career Highlights Ms. Lane retired in 2002 as managing director and group leader of the global Retailing Investment Banking Group of Merrill Lynch & Co., Inc. (“Merrill Lynch”), an investment banking firm. Prior to joining Merrill Lynch in 1997, she was a managing director at Salomon Brothers, Inc. (“Salomon Brothers”), an investment banking firm, where she founded and led the retail industry investment banking unit, having joined Salomon Brothers in 1989. | | | Qualifications Ms. Lane has 26 years of leadership experience with financial services, capital markets, finance and accounting, capital structure, and acquisitions and divestitures in the financial services industry, as well as extensive experience in management, leadership and strategy. Ms. Lane served as a managing director and group leader of the global Retailing Investment Banking Group at Merrill Lynch from 1997 until her retirement in 2002. In that role, she led and worked on mergers and acquisitions and equity and debt transactions for a wide range of major retailers. Prior to joining Merrill Lynch, she was a managing director at Salomon Brothers, which she joined in 1989 and where she founded and led the retail industry investment banking unit. Ms. Lane has | |

| | DAVID L. PORGES | | | Age 66 | | | Independent director since 2020 | |

| | ||||||||

![[MISSING IMAGE: ph_davidporges-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_davidporges-bwlr.jpg) Board Committees » Executive » Finance & Investment (Chair) » Governance & Nominating | | |||||||

| | ||||||||

|

Career Highlights Mr. Porges was a non-employee member of the board of directors of Equitrans Midstream Corporation (“Equitrans”) from November 2018 through December 2019 and was the chairman of the board of Equitrans from November 2018 to July 2019. He joined EQT Corporation (“EQT”) in 1998 as senior vice president and chief financial officer and served as EQT’s CEO from April 2010 to April 2011 and as CEO and chairman from April 2011 to February 2017. From February 2017 to March 2018, Mr. Porges served as EQT’s executive chairman and as chairman and interim CEO from March 2018 to November 2018. | | | Qualifications Mr. Porges has more than 20 years of leadership, finance, operations and mergers and acquisitions experience gained through his prior service as CEO and chairman of a publicly held energy industry company, as well as his prior service as the chief financial officer of that energy company. Mr. Porges also has experience with capital markets, finance and mergers and acquisitions | |

15

| | DEBORAH L. “DEV” STAHLKOPF | | | Age 54 | | | Independent director since 2023 | | |

| ![[MISSING IMAGE: ph_devstahlkopf-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_devstahlkopf-bw.jpg) Board Committees » Audit » Compensation | | | Career Highlights Ms. Stahlkopf joined Cisco Systems, Inc. |

| | | Qualifications Ms. Stahlkopf has extensive experience in | |

16

|

| ||

|

| | |

| | JOHN A. STALL | | | Age 69 | | | Independent director since 2022 | |

| ![[MISSING IMAGE: ph_johnstall-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_johnstall-bw.jpg) Board Committees » Audit » Nuclear (Chair) |

| | Career Highlights Mr. Stall retired from NextEra Energy in 2010, where he served in numerous nuclear leadership roles. He served as president of NextEra Energy’s nuclear division from 2009 to 2010, as senior vice president and chief nuclear officer from 2001 to 2009, as vice | | | Qualifications Mr. Stall has substantial nuclear expertise, operations and engineering experience and leadership experience. He has over 40 years of experience in nuclear generation through his career at both Dominion Energy, Inc. and NextEra Energy. He previously held a senior reactor operator license issued by the Nuclear Regulatory Commission and is a previously licensed professional engineer in the Commonwealth of Virginia. He served as the chair of an independent nuclear safety advisory committee for a publicly-traded electric utility that operates multiple nuclear generating units. He served as a member of the Institute of Nuclear Power Operations National Academy of Nuclear Training Accrediting Board from 2008 to 2019. Mr. Stall graduated from the University of Florida and holds a Bachelor of Science degree in nuclear engineering. He received his MBA from Virginia Commonwealth University. | |

| | DARRYL L. WILSON | | | Age 60 | | | Independent director since 2018 | |

| | ||||||||

![[MISSING IMAGE: ph_darrylwilson-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_darrylwilson-bw.jpg) Board Committees » Audit » Compensation Public Company

» Eaton Corporation plc (since 2021) » Primerica, Inc. (since February 2024) | |

| Career Highlights Mr. Wilson was vice president, commercial of GE Power, a business of GE, from June 2017 until his retirement in December 2017. From January 2016 to June 2017, he was vice president & chief commercial officer of GE Energy Connections and, from January 2013 to January 2016, he was vice president & chief commercial officer of GE Distributed Power. From July 2008 to January 2013, he was president & CEO of GE Aeroderivative Products. Additionally, Mr. Wilson spent 6 years in progressive executive leader roles with British Petroleum —North America in business operations and regional fuel and lubricant distribution management positions. | | | Qualifications Mr. Wilson has extensive leadership and international experience in business operations, commercial management, global manufacturing, mergers and acquisitions and services as a result of his senior leadership roles for a global manufacturer and service provider of | | |

| | | | | The Board unanimously recommends a vote FOR the election of all nominees. | | |

The Board unanimously recommends a vote FOR

18

ProposalPROPOSAL 2: Ratification of appointment of Deloitte RATIFICATION OF APPOINTMENT OF DELOITTE & ToucheTOUCHE LLP as NextEra Energy’s independent registered public accounting firm for 2022

| | | | | The Board unanimously recommends a vote FOR ratification of appointment of Deloitte & Touche LLP as NextEra Energy’s independent registered public accounting firm for 2024. | | |

The Board unanimously recommends a vote FOR ratification

19

ProposalPROPOSAL 3: Approval, by non-binding advisory vote, of NextEra Energy’s compensation of its named executive officers as disclosed in this proxy statement

NextEra Energy Total Shareholder Return Through 12-31-21 vs. Various Indices(1)

1-year TSR | 3-year TSR | 5-year TSR | 10-year TSR | |||||

NextEra Energy | 23% | 129% | 252% | 710% | ||||

S&P 500 Electric Utilities Index, total return | 19% | 56% | 80% | 177% | ||||

S&P 500 Utilities Index, total return | 18% | 49% | 74% | 185% | ||||

UTY, total return | 18% | 54% | 80% | 182% | ||||

S&P 500, total return | 29% | 100% | 133% | 363% | ||||

| | | 10-YEAR TSR | | ||||

| | NextEra Energy | | | | | 267% | | |

| | S&P 500 Electric Utilities Index, total return | | | | | 146% | | |

| | S&P 500 Utilities Index, total return | | | | | 135% | | |

| | UTY, | | | | | 133% | | |

| | S&P 500, total return | | | | | 211% | | |

| | S&P 500 Growth Index, total return | | | | | 250% | | |

| | | | | The Board unanimously recommends a vote FOR approval, by non-binding advisory vote, of NextEra Energy’s compensation of its named executive officers, as disclosed in this proxy statement. | | |

20

for consideration at the annual meeting. In accordance with Securities and Exchange Commission (“SEC”) regulations, the text of thisthe shareholder proposal and supporting statement appearappears exactly as received by the Company. The shareholder proposal may contain assertions about the Company or other matters that the Company believes are incorrect, but the Company has not attempted to refute all of those assertions. All statements contained in the shareholder proposal and supporting statement are the sole responsibility of the proponent. The Company disclaims responsibility for the content of the proposal and the supporting statement.

Furthermore,

Moreover, in its 2021 proxy statement, NextEra provides no particularized data with respect to how its directors’ different qualifications fit together to effectively fulfill the Board’s oversight responsibilities, nor did it explicitly disclose each director’s self-identified race or ethnicity. Carbon-based sources account for roughly half of NextEra’s generating capacity, underscoring the need for a climate-competent Board.

We would also encourage companies to disclose, in aggregate, the number of any self-identified LGBTQ+ director(s).

21

Other leading companies,Your peers, such as Intel, 3M, Home Depot,Exelon Corporation, Honeywell International Inc., and Wells FargoConsolidated Edison have published a Board Matrix with individualized director data in a decision-useful format.data. Their matrices also use EEO-1 categories for disclosing the diversity of individual directors, which allows for consistent and comparable data.

The Board unanimously recommends a vote AGAINST

| | | | | The Board unanimously recommends a vote AGAINST the foregoing proposal for the following reasons: | | |

shareholders because the Board has included a matrix, by individual Board member, of each director’s gender and skills and attributes that are most relevant to the Company’s overall business strategy.

Diversity of experiences and backgrounds are important considerations in identifying and assessing Board candidates. format by current individual director.

NextEra Energy has supplemented its disclosure about Board members skills and attributes.

After conferringcomplied with the proponent, the Company supplementedproposal’s most important request. Supporting this year’s proxy statement with several enhancements, including: a detailed matrix allowing shareholders to easily judge the collective competencies of the Board; clarity between Board qualifications and the competencies sought for director candidates; descriptions of the relevance of each competency to NextEra Energy’s business; and infographics separately identifying the Board’s gender diversity, racial/ethnic diversity and age diversity. This isproposal will not result in addition to the data previously disclosed, including lists of the qualifications and competencies sought by the Board. Additionally, the Board has considered diversity consistently as it engagesany substantial increase in candidate searches.

The Board functions as a collective body on behalf of all the Company’s shareholders.

The imposition of a prescriptive matrix byinformation about individual director can promote a check-the-box approach to refreshment, thus increasing the risk of bypassing a well-qualified candidate, and may mislead shareholders into wrongly believing that only a subset of directors contribute to particular decisions or represent the Board on particular matters. Instead, thedirectors.

| | | | | For the above reasons, the Board unanimously recommends a vote AGAINST this proposal. | | |

For

22

for consideration at the annual meeting. In accordance with SECSecurities and Exchange Commission (“SEC”) regulations, the text of thisthe shareholder proposal and supporting statement appearappears exactly as received by the Company. The shareholder proposal may contain assertions about the Company or other matters that the Company believes are incorrect, but the Company has not attempted to refute all of those assertions. All statements contained in the shareholder proposal and supporting statement are the sole responsibility of the proponent. The Company disclaims responsibility for the content of the proposal and the supporting statement.

Resolved: Shareholders request5

Supporting Statement: Quantitative data is sought so that investors can assess, understand, and compare the effectiveness of companies’ diversity, equity, and inclusion programs and apply this analysis to investors’ portfolio management and securities’ selection process.

Whereas: Numerous studies by respected organizations such as The Wall Street Journal, Credit Suisse, Morgan Stanley, McKinsey, PwC and BCG have pointed to the material benefits of a diverse workforce.

Companies should look to hire the best talent. However, Black and Latino applicants face recruitment challenges. Results of a meta-analysis study of 24 field experiments, dating back to 1990, found that, with identical resumes, White applicants receive an average of 36 percent more callbacks than Black applicants and 24 percent more callbacks than Latino applicants.”latest benchmark criteria

Promotion rates show how well diverse talent is nurtured at a company. Unfortunately, women and non-White employees experience “a broken rung” in their careers. For every 100 men who are promoted, only 86 women are promoted. Non-White women are particularly impacted, comprising 17 percent of entry-level workforce and only

Morgan Stanley has found that “Employee retention that is above industry peer averages can indicate the presence of competitive advantage. This advantage may lead to higher levels of future profitability than past financial performance would indicate.”3 Companies with high employee satisfaction have also been linked to annualized outperformance of over two percent.4

NextEra Energy has not yet committed to release standardized workforce composition data through its consolidated EEO-1 form, which is best practice in diversity data reporting. Nor has it shared sufficient recruitment, retention, and promotion data to allow investors to determine the effectiveness of its human capital management programs.

|

|

|

|

Eighty-one percent

By providing clear, quantitative data on workforce composition, promotion, and retention rates NextEra Energy can help assure that investors are able to compare NextEra Energy’s diversity programs to those of its peers.

The Board unanimously recommends a vote AGAINST the foregoing proposal for the following reasons:

| | | | | The Board unanimously recommends a vote AGAINST the foregoing proposal for the following reasons: | | |

NextEra Energy is committed to diversity, equity and inclusion (“DEI”).

NextEra Energy’s culture and people are among its most important resources and a key competitive advantage. NextEra Energy is committed to attracting and maintaining a diverse workforce. This commitment is supported by the highest levels of Company leadership, as evidenced by the active role that the Company’s management and the Board play in monitoring, evaluating and overseeing the Company’s DEI efforts. The Company’s Executive Diversity & Inclusion (“D&I”) Council is dedicated to advising and driving corporate DEI strategy and partnering with business units in order to promote diverse talent development and recruitment, as highlighted in the Company’s 2021 ESG Report1 and D&I website2. The Executive D&I Council reviews D&I metrics on a quarterly basis, which showcases the Company’s commitment to data-driven results. Such metrics are used to develop annual D&I plans, track progress and implement the Company’s strategies, and are reviewed at least annually by the Board.

In addition, members of the Company’s Corporate D&I Council act as business unit champions by driving business unit D&I strategies, sharing best practices, sponsoring the Company’s annual D&I Summit and advising and mentoring employee resource groups (“ERGs”). The Company’s twelve ERGs are at the heart of the Company’s engagement efforts on DEI. It is within these all-volunteer groups that team members and allies partner to develop personal and professional skills, drive cultural competency and demonstrate advocacy. Examples of the Company’s ERGs include the African-American Professional Employee Group, the Hispanic Organization for Latino Americans, Asian Professionals in the Energy Exchange and Women in Energy, among others.

NextEra Energy already provides extensive information on its DEI efforts and has posted its consolidated EEO-1 reports.

|

|

24

Hawaiian or Other Pacific Islander, two or more races, and Native American or Alaskan Native (2%). The Company plans to provide annual updates to its future ESG reports.

Recognizing that thereshareholder proposal, is a high degree of interest in additional diversity disclosures, the Company has posted its three most recent consolidated EEO-1 reports on the Company’s website3available at www.investor.nexteraenergy.com/corporate-governance. The Company has committedmade a reasonable effort to disclosing its consolidated EEO-1make the disclosures sought by the proponent and plans to update the report to reflect any material changes in lobbying strategy.

review of trade association memberships by the Company’s Vice President, Government Affairs

—Federal. That officer has the responsibility to ensure proper alignment of the Company’s trade association activities with the objectives of the Company. The policy also requires that any policy positions that may be in conflict with the Company’s strategy and objectives are reviewed with the Company’s chairman to ensure that participation in these organizations continues to provide an overall benefit to the Company.The 2021 ESG Report highlights the Company’s focus on recruiting, retaininglobbying efforts, the Board believes the report requested by the proposal would be an unnecessary, duplicative and promoting a diverse and highly skilled workforce. These public materials discloseunproductive use of the Company’s efforts to attend recruiting events across the countrytime and engage with key talent pools, such as Women in Technology International, the National Black MBA Association and the American Indian Science and Engineering Society, as well as several veterans’ organizations. In addition, the 2021 ESG Report discusses the Company’s concerted effort to improve the recruitment, retention and promotion of Black team members4. In light of the continued focus on social justice and racial equity, a racial equity working group, including more than 100 team members, was established to make a positive contribution toward racial equity.

The racial equity working group’s accomplishments so far include:

Partnering with more than 50 organizations to increase Black recruiting opportunities;

Implementing a rotational development program and mentoring program for Black employees;

Supporting 19 key community programs that make a difference in Black communities such as the National Urban League, Black Girls CODE and the Center for Policing Equity;

Commitments to tripling spending with Black owned businesses by 2022; and

Commitments to invest more than $100 million in venture capital and private equity funds that are focused on improving racial equity.

NextEra Energy continues to be recognized for its DEI efforts.

Finally, the Company has also received external recognition for its DEI efforts. In 2021, the Company was named to Forbes magazine’s list of “America’s Best Employers for Diversity” for the fourth consecutive year. In addition, in 2020, the Company was selected by Winds of Change magazine as one of the “Top 50 Workplaces for Indigenous STEM Professionals” for the Company’s strong support for diversity and an inclusive work climate.

The Board does not believe the adoption of this proposal would enhance the Company’s commitment to DEI efforts and improved outcomes.

Unless you specify otherwise in your voting instructions, your proxy will be voted AGAINSTProposal proposal 5.

| | | | | For the above reasons, the Board unanimously recommends a vote AGAINST this proposal. | | |

Forabove reasons, the Board unanimously recommends a vote AGAINST this proposalCompany’s 2023 Sustainability Report, available at https://www.nexteraenergy.com/sustainability.html.

|

|

25

Common Stock Ownership of Certain Beneficial Owners and Management

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | ||

The Vanguard Group 100 Vanguard Blvd. Malvern, PA 19355(1) | 178,849,315 | 9.12% | ||

BlackRock, Inc. 55 East 52nd Street New York, NY 10055(2) | 161,369,326 | 8.20% | ||

State Street Corporation State Street Financial Center One Lincoln Street Boston, MA 02111(3) | 99,606,550 | 5.08% | ||

|

|

|

26,

2024.| | NAME AND ADDRESS OF BENEFICIAL OWNER | | | AMOUNT AND NATURE OF BENEFICIAL OWNERSHIP | | | PERCENT OF CLASS | | ||||||

| | The Vanguard Group(1) 100 Vanguard Blvd. Malvern, PA 19355 | | | | | 198,664,863 | | | | | | 9.7% | | |

| | BlackRock, Inc.(2) 55 East 52nd Street New York, NY 10055 | | | | | 151,490,645 | | | | | | 7.4% | | |

| | State Street Corporation(3) State Street Financial Center One Lincoln Street Boston, MA 02111 | | | | | 116,304,947 | | | | | | 5.75% | | |

| Common Stock Beneficially Owned | Phantom/Deferred Shares(4) | |||||||||||||||

| Name | Shares Owned(1) | Shares Which May Be Acquired Within 60 Days(2) | Total Shares Beneficially Owned(3) | |||||||||||||

Sherry S. Barrat |

| 99,841 |

|

| 11,143 |

|

| 110,984 |

|

| 62,483 |

| ||||

James L. Camaren |

| 149,930 |

|

| - |

|

| 149,930 |

|

| 30,651 |

| ||||

Kenneth B. Dunn |

| 76,570 |

|

| - |

|

| 76,570 |

|

| - |

| ||||

Naren K. Gursahaney |

| 25,390 |

|

| 12,753 |

|

| 38,143 |

|

| - |

| ||||

Kirk S. Hachigian |

| 37,835 |

|

| - |

|

| 37,835 |

|

| - |

| ||||

John W. Ketchum |

| 129,684 |

|

| 463,595 |

|

| 593,279 |

|

| 16,598 |

| ||||

Rebecca J. Kujawa |

| 85,223 |

|

| 110,711 |

|

| 195,934 |

|

| 3,686 |

| ||||

Amy B. Lane |

| 21,193 |

|

| 18,789 |

|

| 39,982 |

|

| - |

| ||||

David L. Porges |

| 28,136 |

|

| 4,799 |

|

| 32,935 |

|

| 6,851 |

| ||||

| �� | ||||||||||||||||

James L. Robo |

| 1,278,372 | (5) |

| 3,233,561 |

|

| 4,511,933 |

|

| 1,570,257 |

| ||||

Rudy E. Schupp |

| 58,330 |

|

| - |

|

| 58,330 |

|

| - |

| ||||

Charles E. Sieving |

| 194,831 |

|

| 183,332 |

|

| 378,163 |

|

| 27,326 |

| ||||

Eric E. Silagy |

| 236,698 |

|

| 713,643 |

|

| 950,341 |

|

| 30,125 |

| ||||

John L. Skolds |

| 47,370 |

|

| - |

|

| 47,370 |

|

| - |

| ||||

John A. Stall |

| - |

|

| - |

|

| - |

|

| - |

| ||||

Lynn M. Utter |

| - |

|

| 4,678 |

|

| 4,678 |

|

| 2,307 |

| ||||

Darryl L. Wilson |

| 12,645 |

|

| - |

|

| 12,645 |

|

| 949 |

| ||||

All directors and executive officers as a group (24 persons) |

| 3,137,301 |

|

| 5,375,165 |

|

| 8,512,466 |

|

| 1,802,048 |

| ||||

(1) Includes shares of restricted stock (performance-based for executive officers) for Messrs. Ketchum (57,867), Crews (18,202), Pimentel (36,807) and Sieving (25,493), Mrs. Kujawa (65,684), as well as for Mrs. Barrat (31,200) and Mr. Camaren (12,800), and a total of 358,813 shares of restricted stock for all | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

27

Delinquent Section 16(a) Reports

The Company’s directors and executive officers as a group. The holders of such shares of restricted stock have voting power, but not dispositive power.

“SERP.”

GUIDELINES/CODE OF ETHICS

In determining that Mr. Schupp is independent, the Board considered that a NextEra Energy subsidiary has employed Mr. Schupp’s son since 2011 in non-executive business roles, for a total compensation in 2021 of approximately $256,000.

Followingbelieves that the decision as to who should serve as chairman and as chief executive officer (“CEO”) and whether the offices should be combined or separate is properly the responsibility of the Board to be exercised from time to time in appropriate consideration of the Company’s then-existing characteristics or circumstances. In view of the Company’s operating record, including its role as a national leader in renewable energy generation, and the operational and financial opportunities and challenges faced by the Company, the Board’s judgment is that the functioning of the Board is generally best served by maintaining a structure of having one individual serve as both chairman and CEO. The Board believes that having a single person acting in the capacities of chairman and CEO promotes unified leadership and direction for the Board and executive management and allows for a single, clear focus for the chain of command to execute the Company’s strategic initiatives and business plans and to address its challenges. However, in certain circumstances, such as the transition of Mr. Robofrom one CEO to executive chairman and Mr. Ketchum to CEO in March 2022,another, the Board believes that it may be appropriate for the roles of NextEra Energy’sthe CEO and the chairman and CEO have beento be separated. As noted under Election of Directors, in order to promote an effective and orderly CEO succession and transition, effective on March 1, 2022, Mr. Robo became executive chairman of the Board and Mr. Ketchum succeeded Mr. Robo as the Company’s CEO. In accordance with the Governance Guidelines, which provide that the Company’s CEO will serve as a director, Mr. Ketchum was appointed to the Board on the effective date of his appointment as CEO.

28

The Board has an independent Lead Director selected by and from the independent directors (with strong consideration given to present and past committee chairs). The Lead Director serves a two-year term commencing on the date of the Company’s annual meeting of shareholders. Unless the independent directors determine otherwise due to particular circumstances, no director will serve as the Lead Director for more than one two-year term on a consecutive basis. Sherry S. Barrat currently serves as the Lead Director, having been appointed initially in May 2020.2020 and reappointed in May 2022 in order to promote an effective and orderly CEO succession and transition. Mrs. Barrat is not standing for re-election having reached retirement age. The independent directors willGovernance & Nominating Committee has recommended that the Board appoint a successorMs. Lane to succeed Mrs. Barrat as the Lead Director atupon Mrs. Barrat’s retirement on the meetingdate of the annual meeting, and the Board immediately followingwill act upon that recommendation no later than the 2022 annual meeting.

meeting date.

»

»

29

| | ![[MISSING IMAGE: tm2228016d1-bx_auditpn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/tm2228016d1-bx_auditpn.gif) | | | | ![[MISSING IMAGE: tm2228016d1-bx_fininvespn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/tm2228016d1-bx_fininvespn.gif) | | | | ![[MISSING IMAGE: tm2228016d1-bx_nuclearpn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/tm2228016d1-bx_nuclearpn.gif) | | | | ![[MISSING IMAGE: tm2228016d1-bx_compenpn.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/tm2228016d1-bx_compenpn.gif) | | | | ![[MISSING IMAGE: ic_governancenomini-ko.gif]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ic_governancenomini-ko.gif) | |

| | AUDIT COMMITTEE | | | | FINANCE & INVESTMENT COMMITTEE | | | | NUCLEAR COMMITTEE | | | | COMPENSATION COMMITTEE | | | | GOVERNANCE & NOMINATING COMMITTEE | |

» Oversees the integrity of the Company’s financial statements, the independent auditor’s qualifications and independence, the performance of the Company’s internal audit function and the Company’s accounting and financial reporting processes

» Oversees compliance with legal and regulatory requirements

» Discusses with management the Company’s policies with respect to risk assessment and risk management

» Reviews and discusses the Company’s major financial risk exposures and the steps management has taken to monitor and control those exposures

» Ensures that risks identified from time to time as major risks are reviewed by the Board or a Board committee | ||||||||||||||||||

| |

| » Reviews and monitors the Company’s financing plans

» Reviews and makes recommendations regarding the Company’s dividend policy

» Reviews risk management activities and exposures related to the Company’s energy trading and marketing operations

» Reviews the Company’s major insurance lines

» Oversees the risks associated with financing strategy, financial policies and the use of financial instruments, including derivatives | ||||||||||||||||

| |

| » Reviews the safety, reliability and quality of nuclear operations

» Reviews reports issued by external oversight groups

» Reviews the Company’s long-term strategies and plans related to its nuclear operations | ||||||||||||||||

| |

| » Oversees compensation-related risks, including annually reviewing management’s assessment of risks related to employee compensation programs

» Oversees the compensation risk mitigation practices and controls that the Company has in place | | | | » Oversees board composition, refreshment and diversity » Annual review of political contributions and trade association memberships » Provides political engagement oversight » Makes recommendations to the Board on the business of the Annual Meeting of Shareholders | |

7.

30

members are incorporated into Board processes and Board agenda topics. This annual self-evaluation process ensures that the Board periodically considers improvements to Board processes and procedures.

Director Meetings and Attendance

shareholders, except for Director Dunn who was unable to attend due to personal matters.

![[MISSING IMAGE: tm2228016d1-fc_committepn.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/tm2228016d1-fc_committepn.jpg)

| | AUDIT COMMITTEE | | | Meetings in 2023: 8 | | ||||

| | ![[MISSING IMAGE: ph_gursahaney-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_gursahaney-bw.jpg) | | |||||||

|

|

| |||||||

Members » Naren K. Gursahaney(Chair) » Nicole S. Arnaboldi » Kenneth B. Dunn » Dev Stahlkopf » John

A. Stall » Darryl L. Wilson

| |

| Primary Responsibilities » Appoints the Company’s independent registered public accounting firm and approves all permitted services to be performed by the firm

» Reviews the independent registered public accounting firm’s qualifications, performance and independence

» Approves the engagement of any other registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services

» Assists the Board in overseeing the integrity of the Company’s financial statements and compliance with legal and regulatory requirements

» Assists the Board in overseeing the performance of the Company’s internal audit function, the accounting and financial reporting processes of the Company and audits of the Company’s financial statements

» Establishes procedures for the receipt, retention and treatment of complaints and concerns received by the Company regarding accounting, internal accounting controls or auditing matters and the confidential, anonymous submission of concerns regarding questionable accounting or auditing matters |

| |||||

31

| | ||||||

| | Qualifications » All members are independent and financially literate under applicable NYSE and SEC requirements » Mr. Gursahaney is an audit committee financial expert under the definition provided by the SEC | | ||||

| | COMPENSATION COMMITTEE | | | Meetings in 2023: 6 | | |||

| | ![[MISSING IMAGE: ph_kirkhachigian-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_kirkhachigian-bw.jpg) | | | |||||

Members » Kirk S. Hachigian (Chair) » Sherry S. Barrat » James L. Camaren

» Dev Stahlkopf » Darryl L. Wilson

| | | Primary

» Reviews and approves corporate goals and objectives relevant to the compensation of the CEO and the other executive officers

» Evaluates the performance of the CEO in light of those goals and objectives, approves the compensation of the CEO and the other executive officers, approves any compensation-related agreements for the CEO and the other executive officers and makes recommendations to the Board with respect to the non-employee directors’ compensation

» Oversees the preparation of the Compensation Discussion & Analysis section of this proxy statement and approves the Compensation Committee Report

» Reviews the results of the Company’s shareholder advisory vote on the compensation of the NEOs, makes recommendations to the Board with respect to incentive compensation plans and other equity-based plans and administers the Company’s annual and long-term incentive plans and non-employee directors stock plan

» Retains, and assesses the independence of, any outside compensation consultants engaged to assist in the evaluation of executive compensation |

| ||||

| | ||||||||

| | |||||||

| | GOVERNANCE & NOMINATING COMMITTEE | | | Meetings in 2023: 6 | | ||||||

| | ![[MISSING IMAGE: ph_amylane-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_amylane-bw.jpg) | | | Members » Amy B. Lane (Chair) » Sherry S. Barrat » Naren K. Gursahaney » Kirk S. Hachigian » David L. Porges | | | Primary

» Reviews the size and composition of the Board, identifies and evaluates potential nominees for election to the Board and recommends candidates for all directorships to be elected by shareholders or appointed by the Board

» Reviews the Governance Guidelines, the Related Person Transactions Policy and the content of the Code of Business Conduct & Ethics and the Senior Code and recommends any proposed changes to the Board

» Oversees the evaluation of the Board

» Makes recommendations to the Board regarding the business of the annual meeting of shareholders, as well as with respect to shareholder proposals that may be considered at the annual meeting » Annual review of political contributions and trade association memberships |

| |||

32

| | ||||||

| | ||||||

| | |||||

| | FINANCE & INVESTMENT COMMITTEE | | | Meetings in 2023: 7 | | ||||||

| | ![[MISSING IMAGE: ph_davidporges-bwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_davidporges-bwlr.jpg) | | | Members » David L. Porges (Chair) » Nicole S. Arnaboldi » James L. Camaren » Kenneth B. Dunn » Maria G. Henry » Amy B. Lane | | | Primary

» Reviews and monitors the Company’s financing plans

» Reviews and makes recommendations to the Board regarding the Company’s dividend policy

» Reviews the Company’s risk management activities and exposures related to its energy trading and marketing operations

» Reviews certain proposed capital expenditures

» Reviews the performance of the Company’s pension, nuclear decommissioning and other investment funds |

| |||

| | |||||||||||

| | ||||||||||

| | NUCLEAR COMMITTEE | | | Meetings in 2023: 4 | | | |||||||

| | ![[MISSING IMAGE: ph_johnstall-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_johnstall-bw.jpg) | | | Members » John A. Stall (Chair) » John W. Ketchum | | | Primary

» Meets with senior members of the Company’s nuclear division

» Reviews the operation of the Company’s nuclear division and makes reports and recommendations to the Board with respect to such matters

» Reviews, among other matters, the safety, reliability and quality of the Company’s nuclear operations and the Company’s long-term strategies and plans for its nuclear operations | |

| ||||

| | Qualifications » Mr. Stall meets the NYSE standards for independence | | | | | ||||||||

| | EXECUTIVE COMMITTEE | | | Meetings in 2023: 0 | | | | | |||

![[MISSING IMAGE: ph_johnketchumsm-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-24-041966/ph_johnketchumsm-bw.jpg) | | | |||||||||

Members » John W. Ketchum (Chair) » Sherry S. Barrat » Naren K. Gursahaney » Kirk S. Hachigian » Amy B. Lane

» David L. Porges | | | Primary

» Provides an efficient means of considering such matters and taking such actions as may require the attention of the Board or the exercise of the Board’s powers or authorities when the Board is not in session | |

| ||||||

Consideration of Director Nominees

access shareholder nomineesAccess Shareholder Nomineesnomineenominee(s) satisfy the requirements in the Bylaws. Notice of proxy access director nominees for the 20232025 annual meeting of shareholders should be addressed to theto:

NextEra Energy, Inc.,

P.O. Box 14000

700 Universe Boulevard

Juno Beach, Florida 33408-0420

33

Other Shareholder Nominees

shareholder nominees

NextEra Energy, Inc.

P.O. Box 14000

700 Universe Boulevard

Juno Beach, Florida

22, 2025.

NextEra Energy, Inc.

P.O. Box 14000

700 Universe Boulevard